In 2024 the economy will be even worse than it is now. the debt will be rising even higher than before and we will never be able to pay it off. the housing will be very bad and everyone will have little money to spend. The president and the government will try and fix this but china and other countries will control most of our economy and our country.

People will have blue collared jobs and very few people will have white colored jobs because it will be hard to find enough money to save for college and get a well paying job so most people will have blue collared jobs. People will be driving around average or used cars and not very many people will have nice cars or nice things to spend their money on. QUESTION: WILL WE BE WEARING SPACE CLOTHES OR TIN FOIL IN THE YEAR 2024?

Wednesday, December 19, 2012

Monday, December 17, 2012

LEHMAN BROTHERS ESSAY SOURCES

My thesis is the very first sentence that is in my paper, sorry I forgot to highlight it and the last page connects the first sentence with the end.

Here are my sources:

1. Penn, Richard J. "Lehman Brothers Holdings Inc." Lehman Brothers. N.p., n.d. Web. 17 Dec. 2012.

2. Jr., John L. "Lehman Brothers." Wikipedia. Wikimedia Foundation, 15 Dec. 2012. Web. 17 Dec. 2012.

3. Keene, Tom. "Lehman Brothers." Bloomberg. N.p., n.d. Web. 17 Dec. 2012.

4. O'Brian, Dan. "Case Study: The Collapse of Lehman Brothers." Case Study: The Collapse of Lehman Brothers. N.p., n.d. Web. 17 Dec. 2012.

5. Kroft, Anton M. "The Case against Lehman Brothers." CBSNews. CBS Interactive, 19 Aug. 2012. Web. 17 Dec. 2012.

Here are my sources:

1. Penn, Richard J. "Lehman Brothers Holdings Inc." Lehman Brothers. N.p., n.d. Web. 17 Dec. 2012.

2. Jr., John L. "Lehman Brothers." Wikipedia. Wikimedia Foundation, 15 Dec. 2012. Web. 17 Dec. 2012.

3. Keene, Tom. "Lehman Brothers." Bloomberg. N.p., n.d. Web. 17 Dec. 2012.

4. O'Brian, Dan. "Case Study: The Collapse of Lehman Brothers." Case Study: The Collapse of Lehman Brothers. N.p., n.d. Web. 17 Dec. 2012.

5. Kroft, Anton M. "The Case against Lehman Brothers." CBSNews. CBS Interactive, 19 Aug. 2012. Web. 17 Dec. 2012.

LEHMAN BROTHERS ESSAY JUSTIN BROWN

Justin Brown

2A

Lehman Brothers Paper

What made the Lehman Brothers go bankrupt in 2008? There is more to the story that appears on newspaper articles and in books, this story has background, history, and family that all contribute and have a big influence on what happened. In 1844 a man by the name of Henry Lehman emigrated from Rimpar, Bavaria to the United States for a better lifestyle. He then settled down in Montgomery, Alabama. When he lived there he opened a dry goods store and named it “H Lehman”. Three years later Henry’s brother Emanuel Lehman moved to Alabama and they both decided to change the store name to “H. Lehman and Bro”, an when their youngest brother Mayer moved to the U.S and helped both of them out with the store, they changed the name to Lehman Brothers and a new era started to form. Back then tobacco and cotton were one of the most important agriculture crops in the U.S, and so the brothers decided to take cotton and trade their goods for cotton because they knew it would go up in value over time (commonly known as bartering). After a few years, their business grew and became a big part of their lives and a hefty source of income. After Henry’s death in 1855 caused by yellow fever, Emanuel and Mayer decided to focus on trading commodities and brokerage operations.

By 1858, the cotton business shifted to New York City from the South and so Emanuel Lehman opened his first branch office in Manhattan and took control to run his business at the age of 32 years old. During the civil war in 1862, Lehman was facing a bit of a difficult time so he decided to team up with a cotton merchant named John Durr and later formed Lehman, Durr and Co. Years passed and the firm finally moved to New York City where they later started the New York Cotton Exchange in 1870. in 1883, Lehman became a member of the Coffee Exchange and finally the New York Stock Exchange in 1899; it was in that same year that Lehman purchased his first stock of the International Steam Pump Company. Even though that was not his main focus, his son, Philip Lehman teamed up with Goldman, Sachs, and Co. to bring the cigar companies in the economic mix. After doing that, Lehman decided to bring in Sears, Woolworth company, Gimbel Brothers Inc., R.H Macy and Company, B.F. Goodrich Co. and much more bigger names.

After Lehman’s Retirement, his son Bobbie Lehman took over as head of the firm. During Bobbie’s tenture, the company weathered the capital crisis of the Great Depression by focusing on venture capital while the market recovered. After Bobbie’s death at only 44 years old, he handed the business over to Pete Peterson. Under Pete’s leadership as CEO, Pete led the firm from significant operating losses to five years of record profits with a return on equity among the highest in the investment banking industry. As Lehman’s empire started to rise further and further, they decided to team up with Shearson and American Express; on May 11th, 1984 the combined firms Shearson Lehman/American Express, and in 1988 Shearson Lehman/American Express merged with E.F. Hutton and C.o and became Shearson Lehman Hutton Inc.

In 1983 to 1990 the CEO of the Shearson Lehman Brothers was Peter Cohen. He led a one billion dollar purchase of E.F Hutton and later formed Shearson Lehman Hutton. During this time period the company Shearson Lehman was busy building it’s leveraged finance business to compete with their main competitor, Drexel Burnham Lambert. These two companies were always competing and always trying to stay one step in front of each other. During this period in time, Lehman was giving out several housing loans to many different people in the U.S and Lehman did not foresee or plan for the future if the housing market were to crash. Lehman had bought several properties for mortgages but when their prices dropped down, it went against the bank. This is what did happen and so the banks raised the interest rates on the housing loans which made the repayment of the loans quite difficult for the borrower’s. In the long run this was a huge blow to Lehman that caused a sixty billion dollar loss to the Lehman Brothers in real estate loans. This truly did hurt and effect the company and it was only going to get worse.

In September, 2008, the president of the federal reserve bank of New York Timothy Geithner planned a meeting on the future of Lehman which involved an immediate liquidation of all it’s assets. Lehman wanted to go to Bank of America and Barclays for acquisition help but both banks, Bank of America and Barclays turned down the offer because they were not pleased with what Lehman did in the past. Lehman had failed to manage good relations with Bank of America and Barclays and along with some of the top banks in America. Lehman was stuck. The snowball effect started to become a nightmare for this company and when it was all said and done, Lehman had a total debt of over six hundred thirty nine billion dollars. Lehman had no choice but to file for bankruptcy on September 15, 2008. The Lehman Brothers bankruptcy is the largest bankruptcy in all of America, and economists say that because of this event, it played a major roll in our late 2000s global financial crisis. On September 20th, 2008, there was an agreement that was approved by the U.S Bankruptcy Court that gave Nomura Holdings permission to acquire the Lehman Brother’s Franchise in the Asia Pacific region including Hong Kong, Japan, and Australia.

This Event changed America and it is sad to see something like this happen to a huge organization. To think that it started with just three brothers that immigrated to the U.S from Bavaria starting their own dry goods store which then later transformed into a multi billion dollar company is unimaginable. It turns out that a well function business must start with good morals and true ethics in order to succeed. It is a shame that the housing market crashed and the debt started to pile up on them, I can relate to this because my dad is a realtor and his business was doing well from 2003-2007 and now it is much more challenging for him to do as well as he was doing due to the market crash; it’s a great time to buy a house on todays market but also a terrible time to sell. It truly is sad to see what happened to the Lehman Brothers but I guess that I learned that in order to manage a well profitable business, it comes down to honesty and trust. If you cannot trust your client or business partner then you cannot progress forward. Trust is key in the business world and it will help a person achieve their goals and make a promising future.

Monday, December 3, 2012

Fiscal Cliff Blog Dec.3rd 2012

Basically the fiscal cliff is a system that started back when president bush was in office and he had it put into action in 2003. It was known as "bush tax cuts" and when Obama was elected he decided to extend it in the "job creation act of 2010". In late February 2012 the Chairman of the federal reserve (Ben Bernanke) popularized the term "fiscal cliff" for this situation.

Th house financial committee described the fiscal cliff as "A massive fiscal cliff of large spending cuts and tax increases" and it will take place on January 1st 2013 (29 days from today). The deficit is the difference between what the government takes in and and what it spends. They want to reduce it by half in the start of 2013. The congressional budget office estimates the sudden reduction will lead to a recession in 2013 and will start to pick up after 2013.

So basically if this system does not get resolved soon enough and they find out a way that to not send us into a recession at the start of 2013 then everything will seem fine. If they don't figure out a solution soon enough in 29 days or less we the people could possibly be headed strait down that cliff and it would end up being another bad thing that happens in America. Hopefully they will resolve this problem so on December 31st people will not question if the sun will rise in 24 hours or less.

Th house financial committee described the fiscal cliff as "A massive fiscal cliff of large spending cuts and tax increases" and it will take place on January 1st 2013 (29 days from today). The deficit is the difference between what the government takes in and and what it spends. They want to reduce it by half in the start of 2013. The congressional budget office estimates the sudden reduction will lead to a recession in 2013 and will start to pick up after 2013.

So basically if this system does not get resolved soon enough and they find out a way that to not send us into a recession at the start of 2013 then everything will seem fine. If they don't figure out a solution soon enough in 29 days or less we the people could possibly be headed strait down that cliff and it would end up being another bad thing that happens in America. Hopefully they will resolve this problem so on December 31st people will not question if the sun will rise in 24 hours or less.

Friday, November 16, 2012

My Manifest

I think that the government should not be as involved in our economy as they are now becasue it could lead to a command economy and we learned that it is not the best way to control our economy. Taxes should be given to everyone and everyone should be able to pay them because if you do not feel obligated to pay them then you should leave. Taxes should be used in our military and given back to large US companies and small businesses and also drilling oil on our land.

The Government should not have control over our health care becasue it will reduce jobs in america and in order to grow we need more US jobs to be successful. Also our taxes should be spent on education so our future children will know more than we will and they will be more successful.

We need to spend lesson infrastructure and more on job creation and lowering unemployment. Aslo less money given to the emergency services and police officers

Monday, October 29, 2012

Minimum Wage

I think that we should get rid of minimum wage. People that have businesses are willing to pay employees what they want to a certain point and I think that some minimum age jobs should get paid more and some should get paid less. for an example I think that my current job at postal connection, I should get paid less because I am not doing much work at all, I'm just getting paid to be there and help out the very few people that come in the door. I'm not saying that I want to get paid less but I would settle for maybe $6.50 an hour. Other jobs that have employees running around and always doing hard work I think that they should get paid more to at least $10.00 per hour because they are working harder vs me just sitting around doing hw and waiting for people to come in the door. Bottom line is I think that they should get rid of minimum wage and that the owner/manager must decide on how hard the job is and how much you can get paid.

Price Floor

I think that putting a price floor on goods and services is a good thing. an example of putting a price floor on a product is a car if the price is high on it then people will not be happy and they will complain about the price.If the price is too low people will buy the product but you will have a low profit margin. By putting a price floor on the product, this allows people to have to buy at a certain price to buy or higher, which meets both supply and demand needs for the producer and the consumer.

price ceilings blog

I think that the government should not put have any price ceilings. When the market price is at an equalibrium, the supply and demand meet. I think that we should not have a price ceiling because it limits people to make their full potential. It messes up with the system and people are not satisfied with what happens. By putting a ceiling price on, this will make the producer have left over product and is unable to sell all of the product.

Thursday, October 18, 2012

Wednesday, October 17, 2012

demand headlines

Demand

1. complementary demand: Usain Bolt tries out for football and gets put on an NFL team, jerseys and football sales sky rocket. 2. substitute demand: All the computers in the world break, everyone switch to books for infomation and ipad sales increase as well.

3. e l a s t i c demand: Soda sales are lowered to 5 cents a liter, soda demands go up and sales rise as well.

4. inelastic demand: toilet paper rises to $20.00 a roll, people crap themselves but they still buy it.

Headline:

TOILET PAPER ROLLS RISE UP TO $20.00 A ROLL!!!!!!!!!!! :O :O :O :O :O :O :O

Toilet paper rolls increase to $20.00 a roll because a major forest fire destroys all of the trees in alaska and the toilet paper companies that need those trees are running low on supplies and inorder to stay profitable they must raise their price on toilet paper because of the few trees left in alaska. There still is a subsitute demand: (leaves) but the people refuse to use sand paper so everyone wants real soft toilet paper. In a way in this situation, toilet paper is an inelastic product and no matter how high the price of toilet paper rises people will still want to buy it; maybe not as much in bulk but they will still want to use it over leaves. In a few weeks the government makes an agreement with the toilet paper companies and they decide to use the trees in oregon for new production and hopfully in 5 weeks toilet paper prices will go down and will soon be baack to normal.

Writer; Justin Brown

Sunday, October 14, 2012

Thursday, October 11, 2012

Demand finale blog

what i have learnd in this unit was very useful and understanding. The subject that i got the most out of was inelastic and elastic demand. inelastic demand are items that you must buy and elastic items are items that you don't need and are willing to subsitute items in for it. I learned that items like: bread, milk, and gasoline are inelastic items and the majority of people will buy those items when the price goes up or down. Products that are elastic such as: pop tarts, coffee, and chips are elastic because you can subsitute other items for them. A question that i have about inelastic and elastic demand is how far will people go as far as subsitute products before they don't want to buy them; and also how high will the price of an inelastic item go until people will not buy the product at all.

Monday, October 1, 2012

Blog entry 4

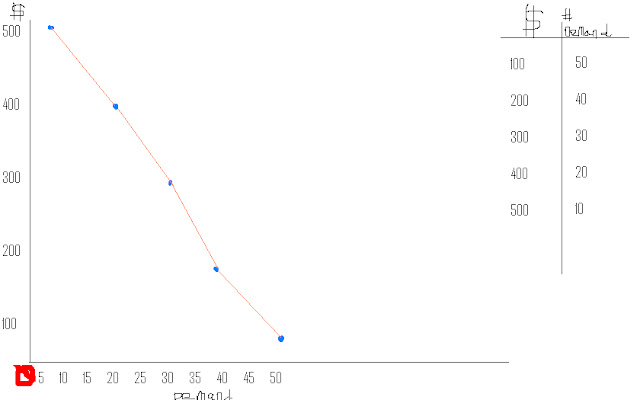

This graph is based on cell phones and the higher price the phone is the lower the demand. the lowest costing phone would be $100 and the highest costing phone would be $500.

Friday, September 21, 2012

blog #3

The market system in the US is a great system. Our economy has notmbeen very good for the past 4 years but hopfully it will bounce back soon. The things that i can relate to this market economy is "major strength of the market economy it is high degree of individual freedom. So in other words, when you have a market economy people can produce whatever they want to, as lojng as they think it will be successfull. I have been in this busness marketing a product called verve and so i can relate to how the market economy works.

A disadvantage of having a command economy is that it is not made to meet all of the wants of the consumers even though many basic needs are provided. So not all of the peoples needs are met with a command economy and that is a bad thing because if they sell a certain amount of shoes in one size then the other sizes will run out much faster and there will only be a certain amount of shoes left that may not fit all of the peoples wants and needs. this is bad because the people will want to leave and go to a different country to get exactly what they want and so they can go into a market economy and buy and sell anything they want. A question i have with a command economy is how many command economies are there in this world and how profitable are they?

A disadvantage of having a command economy is that it is not made to meet all of the wants of the consumers even though many basic needs are provided. So not all of the peoples needs are met with a command economy and that is a bad thing because if they sell a certain amount of shoes in one size then the other sizes will run out much faster and there will only be a certain amount of shoes left that may not fit all of the peoples wants and needs. this is bad because the people will want to leave and go to a different country to get exactly what they want and so they can go into a market economy and buy and sell anything they want. A question i have with a command economy is how many command economies are there in this world and how profitable are they?

Thursday, September 13, 2012

blog 2

At the end of summer last year i was faced with two very important work decisions. #1 do i stay with my current job and work for subway like what i have been doing for the past one and a half years? #2 do i decide it is time to move on and work a different job at Postal Connection and try that out to gain new work experience or continue with what i know and stay at subway. this was not a very hard decision for me and i choose to work at Postal Connection over subway. This was an easy choice for me because the people that i worked with at subway were very rude and did not care too much about customer service, i did not like doing the same thing over and over again every single day; it just got too boring for me and so when i had a new opportunity i had to go for it.

I did not know anything about the business at all and so everything was totally new to me. the thing i really enjoyed about working for postal connection was i was getting paid $12.50 an hour vs.when i worked for subway and i got paid $8.80 an hour and barley any tips with it. I also enjoyed how it was less stressful than subway; you were never slammed to the door at postal connection and you never had any annoying customers yell at you for not doing your job correctly. The opportunity cost that i gave up when i was making my decision was staying with subway and do everything i already knew how to do which was easy, vs quitting subway and trying something totally new that i had no idea what i was doing, but gained more work experience and gain a better opportunity. by doing this i think i choose the correct choice because i wanted to experience more work and see how it can affect me later on in the future. A question i have is what would the opportunity cost be if i stayed with subway and didn't go after my new job? where would i be now? would i be in a better spot or a worse spot then before and how would my opportunity cost effect me?

At the end of summer last year i was faced with two very important work decisions. #1 do i stay with my current job and work for subway like what i have been doing for the past one and a half years? #2 do i decide it is time to move on and work a different job at Postal Connection and try that out to gain new work experience or continue with what i know and stay at subway. this was not a very hard decision for me and i choose to work at Postal Connection over subway. This was an easy choice for me because the people that i worked with at subway were very rude and did not care too much about customer service, i did not like doing the same thing over and over again every single day; it just got too boring for me and so when i had a new opportunity i had to go for it.

I did not know anything about the business at all and so everything was totally new to me. the thing i really enjoyed about working for postal connection was i was getting paid $12.50 an hour vs.when i worked for subway and i got paid $8.80 an hour and barley any tips with it. I also enjoyed how it was less stressful than subway; you were never slammed to the door at postal connection and you never had any annoying customers yell at you for not doing your job correctly. The opportunity cost that i gave up when i was making my decision was staying with subway and do everything i already knew how to do which was easy, vs quitting subway and trying something totally new that i had no idea what i was doing, but gained more work experience and gain a better opportunity. by doing this i think i choose the correct choice because i wanted to experience more work and see how it can affect me later on in the future. A question i have is what would the opportunity cost be if i stayed with subway and didn't go after my new job? where would i be now? would i be in a better spot or a worse spot then before and how would my opportunity cost effect me?

scarcity,yo

An item that is scarce in my house would be a tv. we only have one tv in our house and it is a 55 inch LED sony tv, we did have 3 total tvs in our house but one of them broke and my dad sold the other tv at a garage sale. it is a scarce item because unlike our cells phones, everyone in the house has one unlike our tv, not everyone has a tv in my house. we only have one tv compared to a total of 5 phones in the house.

Subscribe to:

Comments (Atom)